Due dates for GSTR-1 for those taxpayers with aggregate turnover of up to Rs 1.5 Crores p.a

- Chartered Accountant

- Aug 13, 2018

- 1 min read

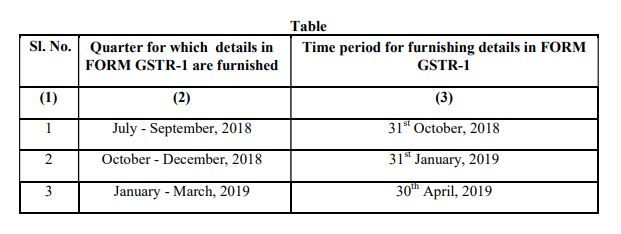

Registered persons having aggregate turnover of up to 1.5 crore rupees in the preceding financial year or the current financial year, as the class of registered persons who shall follow the special procedure as mentioned below for furnishing the details of outward supply of goods or services or both. The said persons may furnish the details of outward supply of goods or services or both in FORM GSTR-1 of the Central Goods and Services Tax Rules, 2017, effected during the quarter as specified in column (2) of the Table below till the time period as specified in the corresponding entry in column (3) of the said Table, namely:-

Comments